Eligible employees of UAB, UAB Hospital and UAB Hospital Management LLC must choose or decline health care coverage during the annual open enrollment Oct. 17-Nov. 3. In addition to the consumer-driven health plan Viva Choice, a traditional health plan from Viva Health and a traditional health plan from Blue Cross/Blue Shield (BCBS) are available for 2026. Employees also may opt to secure dental and vision benefits through separate plans offered.

This is an active enrollment, which means any benefit-eligible employee who does not select a 2026 health care plan option during the enrollment period will not have UAB-provided health care coverage (medical, dental, vision) beginning January 2026.

Medical and dental premium rates will not increase

Despite rising health care costs nationwide, UAB is happy to announce health insurance and dental premiums will not increase for 2026. There will be a slight increase in premium rates for vision plans.

Nationwide, organizations are facing the largest health insurance cost increases in at least 15 years, according to news reports. For UAB to continue offering affordable health plans in the face of these cost increases, we are making plan design changes to include:

Viva UAB and BCBS plan design changes:

- Office visit co-pays will increase by $5 per visit.

- Emergency room co-pays will increase by $25 per visit.

- Inpatient and outpatient hospital co-pays will increase by $50 per visit.

- Prescription co-pays will increase by $5 per script.

Viva Choice plan design changes:

- Deductible increases to $1,800 individual/$3,600 family.

- Out of pocket maximum increases to $3,700 individual and $7,400 family.

All health plans:

Effective Jan. 1, 2026, weight-loss medications — including GLP-1 drugs such as Wegovy, Saxenda and similar treatments — will no longer be covered under UAB’s Express Scripts prescription drug coverage. The coverage that has been offered through Express Scripts is somewhat of an outlier as employers typically do not provide coverage for prescription drugs for weight-loss purposes. GLP-1 drugs prescribed for treatment of diabetes will still be covered under UAB’s Express Scripts prescription drug coverage.

Affordable, high-quality health care coverage

Chief Human Resources Officer Janet May said the diligent efforts of the UAB Benefits office and employee-led Benefits and Wellness Committee kept these necessary plan changes to a minimum. “We are able to provide a choice of high-quality health care coverage at a cost both the individual and the institution can afford,” May said. “Many institutions cannot say the same. The hard work of our Benefits office and Benefits and Wellness Committee is greatly appreciated.”

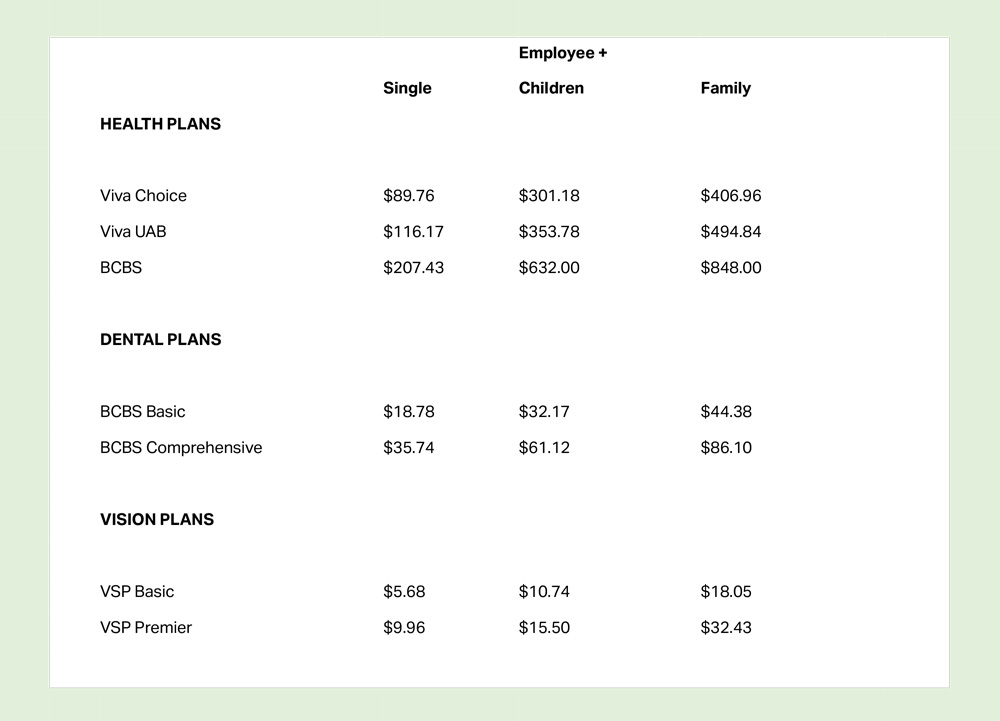

Refer to the chart below for rates based on provider and tier selection.

Premium assistance returns

To ease the cost of medical premiums for qualified employees, UAB offers a premium-assistance program for eligible employees on a UAB health plan. This year, the subsidy is available to employees whose household income, based on family size, is two (2) times the federal poverty level or less.

Employees must apply with the Benefits office directly each year during open enrollment. Those who qualify will be eligible for a fixed amount each payroll period for the 2026 plan year — equivalent to the cost of single employee insurance through Viva Choice. Details are available in the open enrollment toolkit on the UAB for Me benefits portal

No increase for dental plans, slight increase for vision plans

In 2026, premiums for dental plans will remain unchanged. There will be a slight increase in vision plan rates. UAB offers its stand-alone vision benefit through Vision Service Plan, which provides coverage for routine eye exams, lenses and frames, and contacts — both in and outside its network — plus discounts for LASIK eye surgery (in-network only) and other special discounts to plan members. Employees also may choose basic coverage or a premier plan option that includes new replacement frames every year.

More on open enrollment:

Previous: 5 things to know about open enrollment

Consumer-driven health plans can make good financial sense

Two traditional health plan options available for 2026

Dental, vision and voluntary coverage is available during open enrollment

Premium rates for health, dental and vision available for 2026

Next: 9 ways to reduce your health care costs in 2026

UAB offers eligible employees a choice of two stand-alone dental plans — basic or comprehensive coverage provided by Blue Cross and Blue Shield of Alabama.

Refer to the chart above for rates based on plan options and tier selection.

Need help?

All the information employees need to make their selections will be collected in the open enrollment toolkit in the UAB for Me benefits portal. This includes plan details, educational pieces, FAQs, decision-making tools and other resources that can help you make selections.

Employees who want assistance sorting through the options have several choices to help them select the one best suited for their household:

- A plan-shopping application is available during the online open enrollment process.

- HR consultants or HR Benefits representatives are available in individual schools/departments for your convenience.

Live virtual educational sessions explaining 2026 open enrollment information and benefits changes will be held from 1-2 p.m. Oct. 16. Register to attend here.

Meanwhile, contact your school/department HR consultant or the UAB Benefits office at

All elections will be effective Jan. 1, 2026, and premiums for medical, dental and vision coverage will be reflected in the January 2026 payroll.