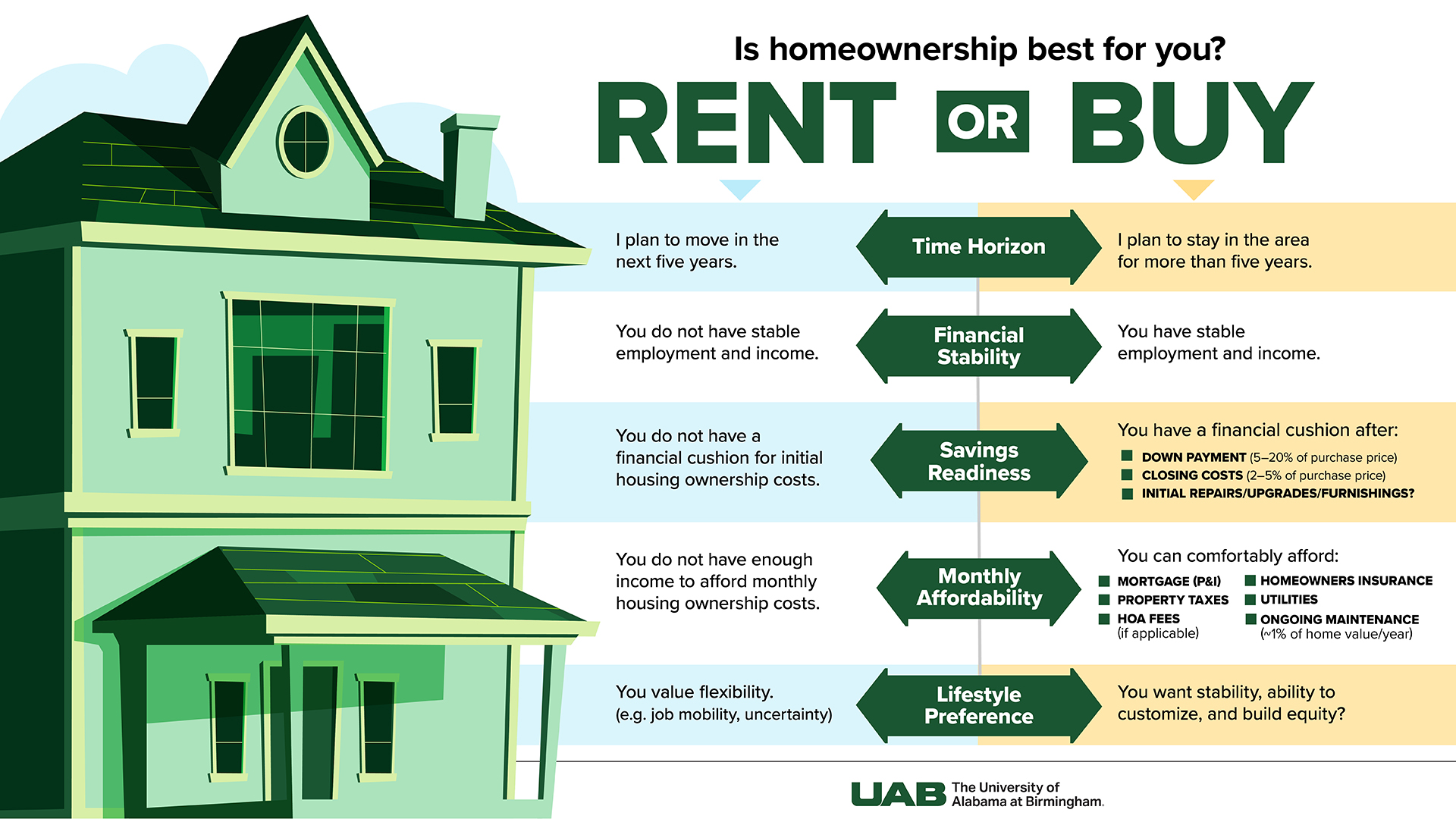

Deciding whether to rent or buy a home is one of the biggest financial choices many people face. While homeownership has long been considered a key step toward building wealth, renting also offers flexibility and fewer financial responsibilities. In today’s market, with rising interest rates and home prices, the decision requires careful thought and planning.

Christopher Edmonds, Ph.D., and Jennifer Edmonds, Ph.D., professors in the Department of Accounting and Finance at the University of Alabama at Birmingham Collat School of Business, say there is no one-size-fits-all answer. The choice depends on personal finances, lifestyle, location and long-term goals.

“Real estate usually gains value over time, and paying a mortgage helps you build equity,” Chris Edmonds said. “But that does not mean buying a house is always the right choice. Renting can be just as smart depending on your situation.”

Why renting might make sense

Renting can be a practical option, especially for people who are unsure how long they will stay in a location, want to avoid the costs of home maintenance or prefer to invest their money in other ways. Monthly rent payments are generally more predictable and do not include property taxes, major repairs or unexpected upkeep. For individuals or families in high-cost real estate markets, renting may provide financial breathing room and more flexibility.

“Renting gives people the freedom to stay flexible and avoid the costs of ownership. Buying can be rewarding if you are ready for the responsibility and plan to stay long term.” – Jennifer Edmonds

“Rising interest rates mean higher monthly mortgage payments, which can put homeownership out of reach for some,” Jennifer Edmonds said. “In many cases, renting makes more financial sense in the short term.”

Renting could appeal to those who value convenience or need to maintain mobility. In a market where housing prices are inflated or inventory is limited, renting may allow potential buyers to wait for better conditions.

When buying a home is the right fit

Buying a home can be a valuable way to build wealth if the buyer is financially prepared and plans to stay in the home for several years. As mortgage payments are made, homeowners gain equity, which can grow further if the property increases in value. Homeownership also offers stability and control, such as the ability to renovate or stay in one place long term.

“Homeownership is a long-term investment,” Jennifer Edmonds said. “If it fits within your budget and aligns with your goals, it can offer both financial and personal rewards.”

There are potential tax benefits as well. Homeowners may be able to deduct mortgage interest and property taxes if they itemize their deductions. Although recent changes in federal tax law have limited these benefits for some taxpayers, they can still provide meaningful savings for those who qualify. Homeownership has traditionally included tax advantages, such as the ability to deduct mortgage interest and property taxes. However, the impact of these benefits depends on a homeowner’s specific financial situation. Many Americans now take the standard deduction and do not itemize, which means they may not benefit from these deductions at all.

“There are still tax perks to owning; but they should be seen as an extra benefit, not the main reason to buy,” Chris Edmonds said.

What buyers often overlook

One of the most common mistakes new homeowners make is focusing only on the monthly mortgage and ignoring other costs. These may include property taxes, homeowners’ insurance, maintenance, repairs and homeowners’ association fees. Failing to budget for these expenses can lead to financial stress.

Some buyers also assume future income growth will cover shortfalls, which can be risky. Others purchase a bigger home than they need or fail to save for emergencies. If an unexpected expense like a roof replacement or job loss occurs, the results can be financially damaging.

“When people stretch their budget too thin, they leave no room for error,” Chris Edmonds said. “Buying a home should come with a plan for both the expected and the unexpected.”

Tips to know before renting or buying

Whether one is renting or buying, UAB experts emphasize the importance of understanding the complete financial picture. They advise that housing decisions should consider more than just comparing monthly rent to a mortgage payment. Factors like maintenance costs, insurance, taxes and long-term financial goals all play a crucial role.

- Budget beyond the mortgage. Homeowners need to plan for property taxes, homeowners’ insurance and maintenance. Experts recommend saving 1 percent to 2 percent of the home’s value each year for repairs and upkeep.

- Build an emergency fund. Big-ticket fixes like heating, ventilation and air conditioning replacement or a new roof can come without warning. Having savings set aside can protect people from financial strain.

- Know your limits. Whether renting or buying, try to keep total housing costs under 30 percent of gross monthly income. This includes rent or mortgage, utilities, insurance, and taxes.

- Watch your overall debt. Total monthly debt payments — including car loans, credit cards and housing — should stay under 35 percent of income.

- Make room for a down payment. If planning to buy, be sure to have money left over for unexpected expenses after paying the down payment and closing costs.

Renters, on the other hand, typically avoid sudden repair costs and can relocate more easily when life changes. That flexibility can be especially helpful in fast-moving or high-cost housing markets.

“In some cases, renting gives people time to save, plan and wait for better buying conditions,” Jennifer Edmonds said. “It can also make monthly budgeting more predictable.”